Tuition/Fees/Aid

Choosing JPII for your child is a commitment to a faith-based education where Catholic ideals and identity are stressed. It is an investment in your child both academically and spiritually.

Naturally, one of the biggest concerns a family addresses when considering a private education for their child is the cost. Within the limits of our funding, we try to make a Catholic high school education available to all who desire this opportunity. Our tuition and fees are very competitive relative to other private schools in the area.

-

Application Fee for 2024-2025 School Year*

Due with application- $25 if received prior to November 15

- $50 if received after November 15

Tuition & Fees for the 2024-2025 School Year (new students)

Annual Tuition $11,000 Annual Student Fees* $1,200 (required to officially enroll a student; payment plans are available) TOTAL $12,200 (the national average for a high school private education is $16,287) All new families also pay a one-time capital improvement fee of $1,000 per family. This fee is also required to officially enroll a student and can also be paid on a payment plan.

*all fees are non-refundable

Five tuition payment options are available:

- Pay in full by June 15

The following options are paid through Finalsite Enrollment on the 15th of the months indicated: - 60% ($6,600) of tuition paid June 15 and the remaining 40% ($4,500) paid in November

- Quarterly payments ($2,750 each) in June, September, December, and March

- Eight monthly payments ($1,375 each) starting August 1

- Ten monthly payments ($1,100 each) starting June 1

All families must register annually with Finalsite Enrollment to manage tuition payments and/or fees throughout the year.

Other Fees

- Transportation $1,250 (full-time)

- Sports Participation Fee – $50 per season, except swimming which is $100 + swimsuit

- AP Exam Fee – TBD each year by The College Board – $98/course for the 2024-2025 school year (students taking AP courses are required to take the AP exam)

- Dual Enrollment Tuition & Fees – set by Pitt Community College

- Graduation Fee (seniors only) – $150

- Pottery, Welding, or Woodworking Class – $75 per course per semester

Other Costs

- Lunch – Varies (JPII does not offer free/reduced lunch)

- Dress Code – Varies

- School supplies range in cost (examples: graphics calculator, notebooks, etc.)

Students may be asked to contribute a small amount for participation in certain extra-curricular activities.

Catholic Education Multi-Student Discount

Families with four or more students currently attending Catholic school (with at least 1 at JPII) will receive 33% off tuition for each student at JPII. Families must request this discount during the enrollment process.529 Education Savings Plans

529 Plans can be used to pay for tuition. Under the Tax Cuts and Jobs Act passed in December 2017, families are allowed to take a qualified distribution of up to $10,000 per year for K–12 tuition at any public, private, or religious school from a qualified 529 Education Savings Plan. -

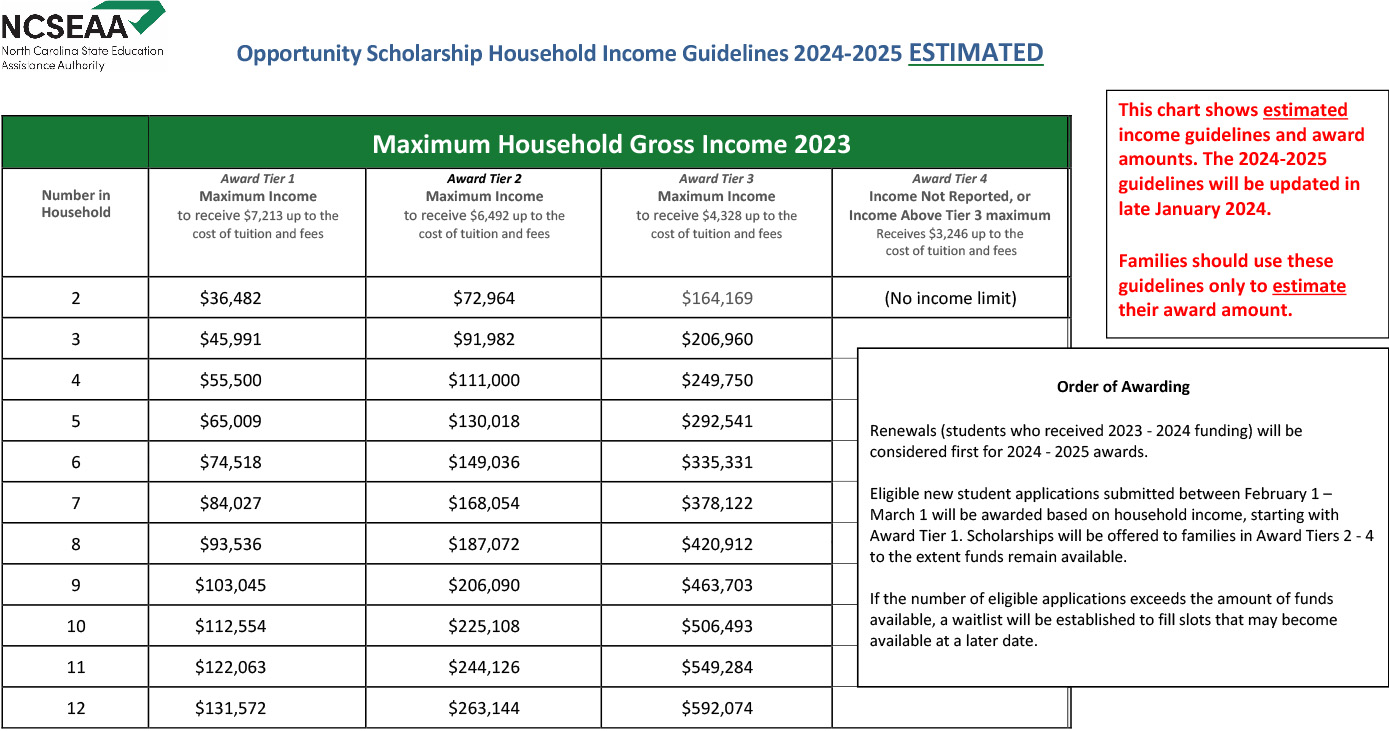

NC Opportunity Scholarship

On October 3, 2023, the North Carolina State Budget (House Bill 259) became law. The new law authorizes several changes to the State’s Opportunity Scholarship Program, which will begin with the 2024-2025 school year.

Changes for the 2024-2025 school year include:

- Removal of the income cap for families to receive the scholarship; now all North Carolina students in kindergarten through 12th grade will be eligible for the Scholarship regardless of income.

- Prior public school enrollment is no longer a requirement for eligibility for the scholarship.

- A student’s scholarship amount will be based on household income.

- Scholarship amounts are estimated to range from $3,246 to $7,213 (see the table below).

The Opportunity Scholarship application for the 2024-2025 school year will open on February 1, 2024. Families must apply by March 1 to receive priority consideration. More information about the application process will be available on the program website in January.

Visit the NCSEAA Opportunity Scholarship page to learn more and apply starting February 1, 2024.

Education Student Accounts (ESA+) (previously referred to as NC Children’s with Disabilities Grant)

The ESA+ program provides scholarships in the amount of up to $9,000 a year, and to cover expenses related to educating a child with a disability* in a participating nonpublic (private or home) school.- Covers tuition and fees at participating schools

- No out-of-pocket expenses (provides families with an electronic debit account)

- Funds can be used for expenses such as speech or occupational therapy, tutoring services, curriculum, and educational technology

*A student who has an eligibility determination from a North Carolina Individualized Education Program (IEP) dated within the last three years. A current Eligibility Determination form (DEC3 or ECATS) is the form to submit with an application.

-

Financial Aid

Our school believes all students who exhibit hard work and a strong will to succeed, regardless of faith and background, would benefit from a private education at JPII. To be eligible for financial aid, a family must demonstrate financial need based on the FACTS Grant & Aid financial need assessment. Generally speaking, historically the FACTS Grant & Aid assessment has not shown financial need for families with an adjusted gross income (AGI) of $100K or greater.

Our school believes all students who exhibit hard work and a strong will to succeed, regardless of faith and background, would benefit from a private education at JPII. To be eligible for financial aid, a family must demonstrate financial need based on the FACTS Grant & Aid financial need assessment. Generally speaking, historically the FACTS Grant & Aid assessment has not shown financial need for families with an adjusted gross income (AGI) of $100K or greater.Financial aid can cover a portion of the tuition and fees for families who qualify, but not all of it.

Families can begin an application for financial aid through FACTS Grant & Aid at any time; however, the financial aid committee does not review applications for financial aid until a student has gone through the admissions process and received a letter of acceptance. Also, families requesting financial aid must have either:

- submitted an application for the NC Opportunity Scholarship (click here to submit an application), or

- if the Opportunity Scholarship application is closed, provide proof they have requested to be notified once the application reopens (click here to request to be notified).

The review of financial aid applications by the committee does not include information that would reveal the identity of the applicant.

Click here for instructions on how to submit a FACTS Grant & Aid application to demonstrate financial need.

-

JPII utilizes Finalsite Enrollment to service tuition payments and fees throughout the year (ex: sports participation fees). Families can access their Finalsite Enrollment accounts via the button below.

JPII utilizes Finalsite Enrollment to service tuition payments and fees throughout the year (ex: sports participation fees). Families can access their Finalsite Enrollment accounts via the button below. -

Families have the option to finance tuition through Your Tuition Solution.

Families have the option to finance tuition through Your Tuition Solution. -

Withdrawal Policy

Families must notify the school in writing and sign the official JPII withdrawal form if a student is withdrawing from the school.

- Enrolled students who withdraw before the first day of school are responsible for 1/2 of the full tuition amount.

- Enrolled students who withdraw after the first day of school are responsible for the full tuition amount.

- All fees (including, but not limited to, annual student fees, capital improvement fees, and course fees)

are non-refundable. - The school will not forward records for students who withdraw with an outstanding balance.